What is DeFi?

The decentralized finance (DeFi) industry has been booming since mid-2020 and gathers more and more users. Indeed DeFi platforms such as decentralized exchanges (DEX), lending, or investment platforms, recreate the traditional financial applications using cryptocurrencies and smart contracts. They provide the user all the benefits of decentralization.

However, the DeFi boom also brings increased risks to the market. In the last few months, there have been a good number of hacking incidents targeting DeFi platforms, for example, EasyFi1 in April or FinNexus2 last month.

DeFi compliance: Are regulators coming for DeFi?

Since the DeFi industry is largely unregulated and relies on P2P transactions, it grows concerns from worldwide regulators. Indeed, DeFi platforms can facilitate fraud, money laundering (ML) and terrorism financing (TF), or illicit financial activities. DeFi's decentralized nature is one of the main factors of facilitation.

In March 2021, FATF took this into consideration in its latest published draft guidance3 that could require DeFi platforms to conduct know-your-customer (KYC) on their customers. Besides, Thailand’s regulators also seek to regulate DeFi. At the beginning of June, Thailand SEC announced4 that DeFi platforms involved in token issuance could need a license to operate.

These two examples could be the beginning of broader regulations on DeFi. The aim would be to prevent nefarious actors to use the platforms for unlawful purposes. It is likely that DeFi compliance will become a hot topic in the near future.

In early 2021, Scorechain published a report regarding the topic: State of Money Laundering & Terrorism Financing through Decentralized Exchanges.

DeFi compliance 101

Scorechain Blockchain Analytics platforms provide compliance teams with useful tools to mitigate risks related to DeFi platforms or Dex.

Risk Scoring

First, Scorechain assigns a medium score to ‘Decentralized Service’ wallets. Also, ‘Dex’ entities have a medium score by default. But it can vary depending on different factors such as if the platform is open or if it suffered a hack. Users can customize the default score of ‘Dex’ and ‘Decentralized Service’ entities on the platform. Thus, they can adapt to users' internal policies. Scorechain users can also check these entities’ computing scores based on the source/destination of their funds.

Risk indicators

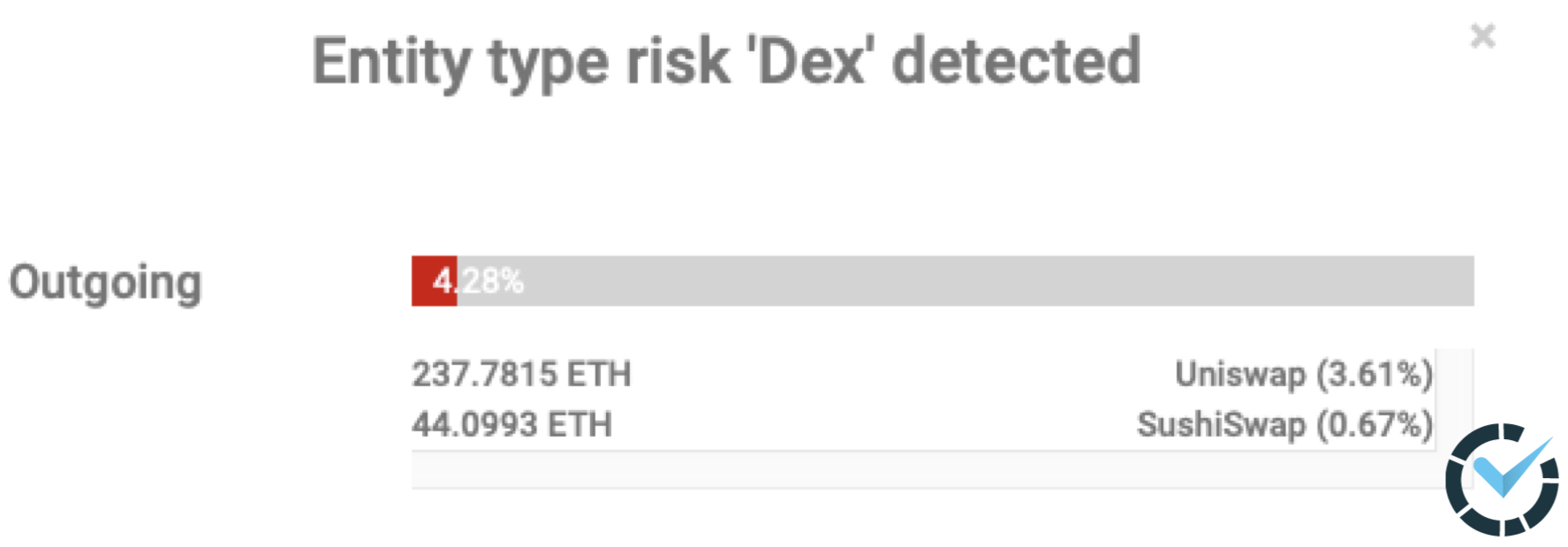

Scorechain users can set up the risk indicators ‘Dex’ and ‘Decentralized Service’. They will be triggered on any wallet that transacted with such entities. Therefore, Scorechain users are able to identify if the wallets they are checking have transacted with a DeFi platform. Thus they are able to take appropriate measures.

Dex risk indicator triggered on Scorechain Etherereum Analytics platform

Dex trade

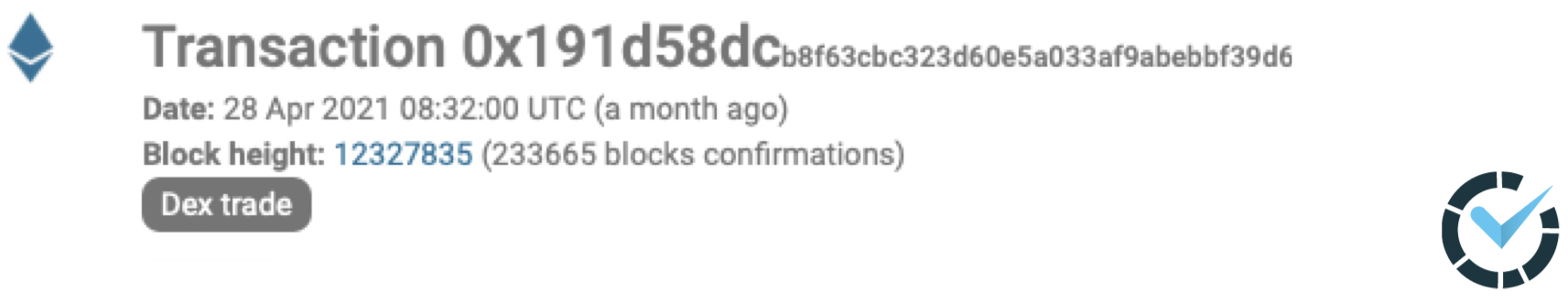

Scorechain Ethereum Analytics platform identifies Dex transactions. Also, it allows users to easily trace coins even after Dex swaps. For example, if a transaction is conducted through a Dex, the platform will display “Dex trade” on the transaction page as shown below.

A Dex transaction on Scorechain Ethereum Analytics platform

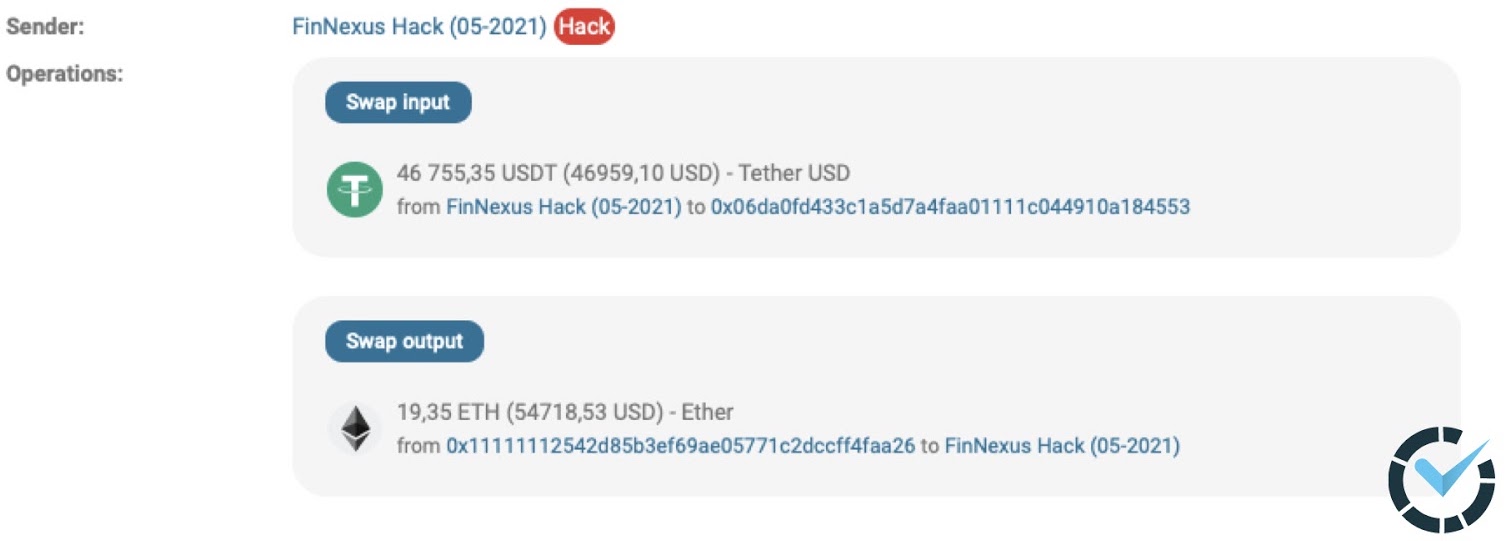

The platform also gives information on swaps. For example, in May, the cross-chain DeFi protocol FinNexus suffered a hack. In the example below, we can see that the hacker swapped Tether for Ether trying to launder the funds in the process. However, even though the funds have been swapped, they are still “tainted” coins thus have a low score.

Swap information on Scorechain Ethereum Analytics Platform

Also, Dex transaction information will be equally displayed on Know-your-address (KYA) and Know-your-transaction (KYT) reports generated by users.

Discover how Scorechain helps with DeFi compliance

Scorechain solution helps mitigate risks stemming from the use of DeFi platforms and helps worldwide crypto businesses meet regulatory requirements on cryptocurrencies. You are a company dealing with cryptocurrencies and you seek to mitigate risks related to DeFi activities?

Don’t hesitate to reach out to schedule a demo: contact@scorechain.com

About Scorechain

Scorechain is a Risk-AML software provider for cryptocurrencies and digital assets. As a leader in crypto compliance since 2015, the Luxembourgish company serves worldwide customers in 36 different countries with more than 200 licenses established, ranging from cryptocurrency businesses to financial institutions with crypto trading, custody branch, digital assets customers onboarding, audit and law firms and some LEAs.

Scorechain solution supports Bitcoin analytics with Lightning Network detection, Ethereum analytics with all ERC20 tokens and stablecoins, Litecoin, Bitcoin Cash, Dash, XRP Ledger and Tezos. The software can de-anonymize the Blockchain data and connect with sanction lists to provide a risk scoring on digital assets transactions, addresses and entities. The risk assessment methodology applied by Scorechain has been verified and can be fully customizable to fit all jurisdictions. 300+ risk-AML scenarios are provided to its customers with a wide range of risk indicators so businesses under the scope of the crypto regulation can report suspicious activity to authorities with enhanced due diligence.

References:

- https://medium.com/easify-network/easyfi-security-incident-66c02a277a91

- https://twitter.com/Phoenix__PHX/status/1395757460078546950

- https://www.fatf-gafi.org/media/fatf/documents/recommendations/March%202021%20-%20VA%20Guidance%20update%20-%20Sixth%20draft%20-%20Public%20consultation.pdf

- https://www.sec.or.th/TH/Pages/News_Detail.aspx?SECID=8976